Hurst exponent stock trading

In the celebrated British hydrologist H. Hurst was looking for a way to model the levels of the river Nile so that architects could construct an appropriately sized reservoir system. Put simply, the Hurst exponent is used as a measure of the long-term memory of a time series. In addition to the Hurst exponent, Mandelbrot also coined two more terms useful in describing the long-term memory of a time series.

Examining the Hurst Exponent for Algorithmic Trading - Robot Wealth

He called the first one the Joseph Effect and the second one the Noah Effect. The Joseph Effect tells us whether movements in a time series are part of a long-term trend and refers to the Old Testament where Egypt would experience seven years of rich harvest followed by seven years of famine.

The Noah Effect is the tendency of a time series to have abrupt changes and the name is derived from the biblical story of the Great Flood. Both of these effects in a time series can be inferred from the Hurst exponent. The Hurst exponent is not so much calculated as it is estimated.

A variety of techniques exist for estimating the Hurst exponent H and the process detailed here is both simple and highly data intensive.

To estimate the Hurst exponent one must regress the rescaled range on the time span of observations.

ETF Pairs Trading with the Kalman Filter

To do this, a time series of full length is divided into a number of shorter time series and the rescaled range is calculated for each of the smaller time series. A minimum length of eight is usually chosen for the length of the smallest time series. So, for example, if a time series has observations it is divided into:.

The rescaled range and chunk size follows a power law, and the Hurst exponent is given by the exponent of this power law. When the frequency of an event varies as the power of some quantity associated with the event, it is said to follow a power law. A wide variety of natural and manmade phenomena follow a power law.

Using the Hurst exponent we can classify time series into types and gain some insight into their dynamics. Here are some types of time series and the Hurst exponents associated with each of them. A Brownian time series: Series of this kind are hard to predict.

Figure 1 provides an example of a Brownian time series and its estimated Hurst exponent. The Hurst exponent for the data plotted above was estimated to be 0. An anti-persistent time series: In an anti-persistent time series also known as a mean-reverting series an increase will most likely be followed by a decrease or vice-versa i.

This means that future values have a tendency to return to a long-term mean. Figure 2 provides an example of an anti-persistent time series and its estimated Hurst exponent.

Strategy Portfolio Construction

A Hurst exponent value between 0 and 0. A persistent time series: In a persistent time series an increase in values will most likely be followed by an increase in the short term and a decrease in values will most likely be followed by another decrease in the short term.

Figure 3 provides an example of a persistent time series and its estimated Hurst exponent.

The plot shows the intra-day tick level data for an NYSE traded fund. The Hurst exponent was estimated to be 0. A Hurst exponent value between 0.

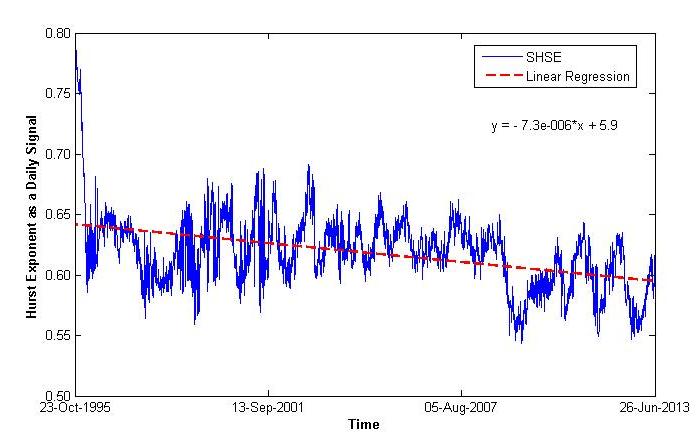

The Hurst exponent is a useful statistical method for inferring the properties of a time series without making assumptions about stationarity. It is most useful when used in conjunction with other techniques, and has been applied in a wide range of industries.

For example the Hurst exponent is paired with technical indicators to make decisions about trading securities in financial markets; and it is used extensively in the healthcare industry, where it is paired with machine-learning techniques to monitor EEG signals. The Hurst exponent can even be applied in ecology, where it is used to model populations. Attributes that often get someone hired as CEO may not be the ones that drive success once they are at the helm of the company.

The study, recently featured in Harvard Business Review, identifies characteristics that differentiate the most effective leaders. Online user reviews have become an essential tool for consumers who increasingly rely on them to evaluate products and services before purchase.

The business models of online review platforms such as Yelp and TripAdvisor and e-commerce sites such as Amazon and Expedia critically depend on them. Should such sites pay users to encourage them to write reviews? CIOs have a major role to play in preparing businesses for the impact that artificial intelligence AI will have on business strategy and human employment, according to Gartner, Inc.

Gartner predicts that by , smart machines and robots may replace highly trained professionals in tasks within medicine, law and IT. Estimating the Hurst exponent The Hurst exponent is not so much calculated as it is estimated.

So, for example, if a time series has observations it is divided into: For each chunk of observations, compute: Finally, average the rescaled range over all the chunks. Interpreting the Hurst Exponent Using the Hurst exponent we can classify time series into types and gain some insight into their dynamics. Conclusion The Hurst exponent is a useful statistical method for inferring the properties of a time series without making assumptions about stationarity.

Subir Mansukhani is an innovation lead analyst with Mu Sigma. Shedding light on a new business asset. Headlines What you like in a CEO candidate may not deliver results Attributes that often get someone hired as CEO may not be the ones that drive success once they are at the helm of the company. Take the exam close to home and on your schedule: Advertising Employment Subscriptions Privacy Policy About INFORMS Contact Us. Close Window Loading, Please Wait! This may take a second or two.