Momentum and contrarian trading strategies

Contrarian Traders | Investopedia

Contrarian is an investment style that goes against prevailing market trends by buying poorly performing assets and then selling when they perform well.

A contrarian investor believes the people who say the market is going up do so only when they are fully invested and have no further purchasing power. At this point, the market is at a peak; when people predict a downturn, they have already sold out, at which point the market can only go up.

For more on indicators that contrarians monitor, check out the article "Why is the disparity index indicator important to contrarian investors? Contrarian investing is a type of investment strategy distinguished by buying and selling against the grain of investor sentiment during a specific time.

A contrarian investor enters the market when others are feeling negative about it and the value is lower than its intrinsic value. When there is an overarching pessimistic sentiment on a stock, it has the possibility of lowering the price so low, the downfalls and risks of the company's stock are overblown. Figuring out which distressed stocks to buy and selling them once the company recovers, thus boosting the stock value, is the major play for contrarian investors.

Momentum and Contrarian Trading Strategies: Evidence from the Chinese stock market

This can lead to securities returning gains much higher than usual. However, being too optimistic on hyped stocks can have the opposite effect.

Many contrarians have the view of the market as an eternal bear market. This does not necessarily mean they view the market as negative but keep a healthy skepticism as to how certain general investors feel about the market.

Overly high valuations can lead to eventual drops when investors' expectations do not work out. The principles behind contrarian investing can be applied to individual stocks, an industry as a whole or even entire markets. Contrarian investing is similar to value investing because both value and contrarian investors look for discrepancies in price between investments, seeing if an asset class is undervalued in the current market.

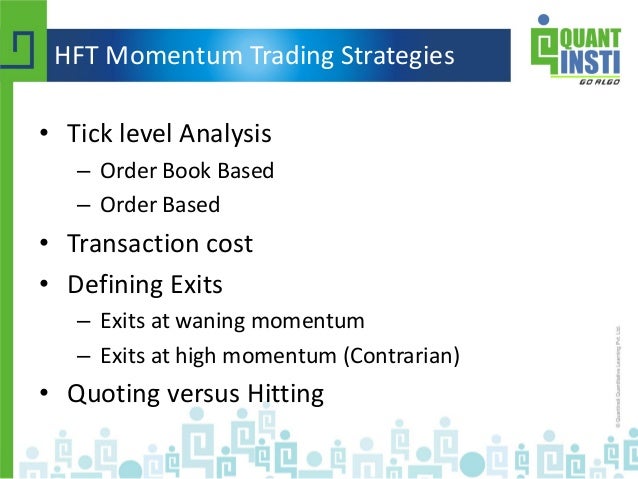

Momentum Trading Strategies For BeginnersMany famous value investors see there is a fine line between value investing and contrarian investing as they both look for undervalued securities to turn a profit dependent on reading the current market sentiment. Contrarians also touch upon a lot of basic principles included in behavioral finance.

Contrarian

Some behavioral finance ideas are that of investors as a collective and their interaction with trends. For example if a stock has been performing badly, it is going to stay that way for some time, along with a secure strong stock also staying that way.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Disparity Index Fade John Neff Sell Signal Investment Philosophy Undervalued Value Stock Valuation Relative Value. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.