Yearly stock market return

However, that number can be very misleading. Accurate calculations of average returns, taking all significant factors into account, can be challenging. The index primarily mirrors the overall performance of large-cap stocks. The 30 stocks that make up the Dow Jones Industrial Average were previously considered the primary benchmark indicator for U.

There is an additional problem posed by the question of whether that inflation-adjusted average is accurate since the adjustment is done using the inflation figures from the Consumer Price Index CPI , whose numbers many analysts believe vastly understate the true inflation rate. For an individual's investment success, when he chooses to enter the market makes a significant difference.

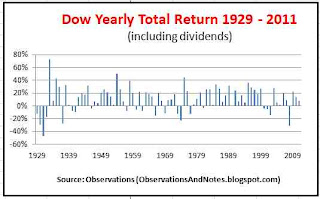

The stock market performed very well for an investor who bought stocks between and , but the market was nothing but a continuous year disappointment for an investor who entered in The market's best sustained performance was from to Calculating in the effect of an investor reinvesting all dividends received would render the historical performance figure substantially higher. It depends on what time period is used. For example, the average annual return from August to March was That was a long secular bull market.

If you look at the secular bull markets since to the end of , it seems like the average return has increased for each successive secular bull, but the time has been shorter. The secular bull from to was an increase of 10 fold in 18 years. The question is whether we entered a new long-term secular bull market in or and how long will it last.

I believe we did and the duration will be less than 18 years. There is one other factor to consider in all this. Things are changing ever more rapidly. Let me ask you a question. If you started with a penny and each time you received twice what you had the day before, how much money would you have at the end of 30 days?

Take a guess before you read further. The curve in the beginning looked like a flat line. It is only when the curve turns sharply upward that you realize it is exponential. I think an argument can be made it is showing that characteristic. And the speed of turnover seems to validate that. While many market pundits are publicizing a view that returns are going to be significantly lower than history, I believe they are going to be shocked with what the returns will actually be.

The danger is investors who buy into the view of lower returns. Instead of firing their advisor for lousy results they will keep the advisor because the so-called experts said to expect low returns. It all depends on your time frame. This is highly dependent on the period of time being observed or calculated. It is important to note the difference between average returns and the internal rate of return for an investor. The information, data, analyses and opinions contained herein do not constitute legal advice offered by Kinetic and are provided solely for informational and educational purposes.

While the information and statistical data contained herein are based on sources believed to be reliable, Kinetic does not represent that it is accurate and should not be relied on as such or be the basis for a decision.

Investment Advisory Services are offered through Kinetic Investment Management, Inc. Dictionary Term Of The Day.

Average Stock Market Return: Where Does 7% Come From? - The Simple Dollar

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You. Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Most Helpful Most Recent. Snider, Scott Jacksonville, FL.

Hughes Optioneering

Free Consultation Was this answer helpful? Investopedia New York, NY. Adams, Alexander Michael Seattle, WA. Timotic, Dan Oakbrook Terrace, IL.

Hashemian, Ali Los Angeles, CA. Investopedia does not provide tax, investment, or financial services. The information is not meant to be, and should not be construed as advice or used for investment purposes.

While Investopedia may edit questions provided by users for grammar, punctuation, profanity, and question title length, Investopedia is not involved in the questions and answers between advisors and users, does not endorse any particular financial advisor that provides answers via the service, and is not responsible for any claims made by any advisor.

The Historical Returns of Income-Producing InvestmentsInvestopedia is not endorsed by or affiliated with FINRA or any other financial regulatory authority, agency, or association. All Rights Reserved Terms Of Use Privacy Policy.