Stock market pro icici

ICICI Bank is one of the largest private sector banks in India with better NPA levels than most government-owned banks in India. The stock has declined due to the general weakness in commodity prices and increasing stress amongst Indian corporates; should rebound as it did back in The fall in price is mainly due to the commodity market falling, leading to increased stress amongst Indian mining, metal and infrastructure companies.

There is a general sentiment that banks with exposure towards the corporate sector will not fare well since they lend to the industrial houses in India.

While public sector banks had been falling earlier, now even private sector banks have seen their prices declining. ICICI Bank has bounced back after the downturn, and I believe it will do so again.

ICICI Bank is one of the largest private banks in India and has got a tremendous network across India. The bank has shown good improvement in its asset quality on a sequential basis, and its NPAs are quite low when compared to most of the state banks in India.

Banks across the world USAItaly have faced a bad January, as the Chinese slowdown has led to an increase in risk aversion across markets.

However, given the strong growth profile of the Indian economy and ICICI's strong position, I think the dip in prices offer a good time to invest in this ADR. India's inflation reached a record low of 3. It has come down substantially from India's currency has stood strong at a time when most currencies have tumbled against the USD.

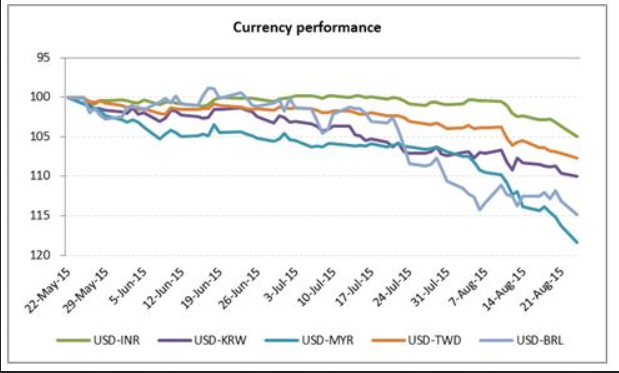

Asian currencies have fallen up to 3. In comparison, the Indian currency fell only by 1.

Even inthe performance of the Indian currency was much better than other emerging market currencies. Major economies are feeling the heat due to a slowdown in the Chinese market.

India has been relatively insulated, mostly because of its low reliance on the Chinese economy. Payment companies such as PayTM, PayU etc. Rapid changes in technology have increased pressure on traditional players.

what is fees for stock market pro course at icici and what are days at which classes are held

ICICI Bank already has a strong digital reach. Its iMobile app has already eased the overall banking experience for its customers, who can now make direct calls to call centers and withdraw cash from ATMs without using a card. The banking company recently announced other digital initiatives - Express Home Loans and iLoans that will ease the assessment process of new home loans.

These could get a home loan approval in as quickly as eight working hours and also home loans for under construction projects. We believe these initiatives will bring simplicity to the home loan process, while delivering solutions at a never seen before speed," said Rajiv Sabharwal Executive Director ICICI Bank.

State-run banks in India had gross NPAs of INR 3.

Though the RBI Governor has pledged to clean up the balance sheets of these banks by Marchstill a lot needs to be done. In comparison, ICICI's net NPA was 1. There was also a small sequential decline in both net and gross NPAs.

ICICI Bearish DOW – Stock Market Analysis

Gross NPAs of state-run banks stock market annual return graph The banking company lent more than INR 1trillion, making it bcit stock trading first amongst private stock market pro icici banks in the country.

The power industry is becoming an increasingly distressed sector in India, and private sector banks are suffering due to their increased exposure to the power sector in India.

The global economy is facing significant slowdown risks due to falling oil prices and increasing credit buy compression stockings massachusetts in the Chinese economy, which has made investors jittery. The Chinese market weakness has affected all countries as most economies China, Russia, Canada, Australia etc.

If investors become more risk averse, banking stocks will see further downsides as they have greater correlation with economic growth. Foreign Money is already flowing out of the Indian stock market. If the stock market pro icici emerging market weakness accelerates, then this might lead to a further plunge in stock prices.

The Indian industrial companies are already facing debt repayment issues due to lower revenues and profits. If commodity prices go lower, then some of them may go bankrupt leading to larger NPAs for Indian banks. Though the stock price has fallen sharply, I think the stock will rebound just as it happened earlier in Given the low valuation, I think this is a good time to take advantage of the low price and invest in this stock.

ICICI Bank is a one of the largest corporate entities in India, with a recognized brand name and a strong franchise. USA-based credit rating agency, Moody's, upgraded the outlook towards Indian banking sector from negative to stable.

IBN is a good stock to own, as it is one of the few universal banks in India and has strong growth engines in the form of its insurance and brokerage businesses. As India's economy continues to improve, the NPA problem should get solved. I think it is a good time to build a position in ICICI Bank at these cheap valuations.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article.

I hold Mutual fund units that invest in this stock. Long Ideas Short Ideas Cramer's Picks IPOs Quick Picks Sectors Editor's Picks. ICICI Bank's Future Remains Bright Feb. Summary ICICI Bank is one of the largest private sector banks in India with better NPA levels than most government-owned banks in India. Why is IBN a good stock to own 1 India is set to see strong growth going forward - India is seeing higher GDP growth, low interest rates and favourable structural reforms.

Investing IdeasLong IdeasFinancialForeign Regional BanksIndia. Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here. Follow Sneha Shah and get email alerts.