Rsu vs stock options calculator

Over the past month I have been asked this question more times than I can count and so I thought it was a great topic to write about.

Although they are similar in many ways, they have huge differences that can affect ones decision about which to use, if given the choice. Many companies have shyed away from Stock Options and towards Restricted Stock Units RSU because of a change in tax reporting that requires them to expense employee stock options.

Stock Options are the right to buy a specific number of shares in the future at a pre-set price grant price.

What to pick: RSU or stock options? - fadukuvo.web.fc2.com

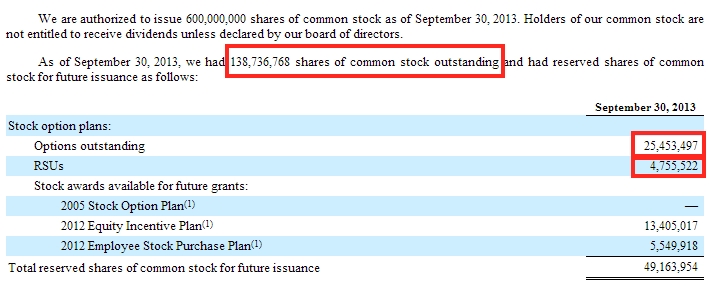

In general, options vest three years from the date of the grant, and option holders have an additional seven years from the vesting date to exercise them exercise period. Restricted Stock Units RSU are a grant of units, with each unit, once vested, equal to a share of stock. Company stock is not issued at the time of the grant.

However, when RSUs vest, you will receive one share of company stock for each RSU that vests. Options have value if the stock price rises above the grant price, but could have no value if the stock price is at, or below, the grant price.

RSUs will always have value, whether the stock price goes up or down. The value of your award will increase if the price goes up and decrease if it goes down.

In most cases options are taxed as income at the time of exercise, regardless of whether shares are sold or held.

Taxes on gains also may need to be paid upon subsequent sale of shares. Speak with a tax accountant to determine what your taxes will be.

RSUs or Options Which is better for the employee?

Here are the questions I usually want to find out about the employee and the company before making a recommendation:. If the employee answers that they have a very low risk tolerance then I would never recommend them choosing options, if given the choice. This is because with an RSU, they are given the right to actual shares not the right to buy shares at a given price. Look at Merck MRK for example. These options never were worth anything. If the company had given RSUs instead, although they would be worth less than they were when granted, it would have given some return.

If the employee answers that they have at least a moderate risk tolerance, the above questions would make a difference to which to choose. If the answers about the stock are that it: I personally prefer RSUs because of the limited risk in them. Yes, there is more upside potential in an option because of the number of options issued compared to the number of RSUs for the same plan.

I hope this helps explain the complicated bonus plans and which may be best for you. Please contact me with any questions or comments,. Your use of this service is subject to our Terms of Use and Privacy Policy. Information is provided 'as is' and solely for informational purposes, not for investment purposes or advice. BrightScope is not a fiduciary under ERISA.

BrightScope is not endorsed by or affiliated with FINRA. Menu Log In Sign Up About Us. Which is better fo Which is better for the employee? Here is table that compares both: Stock Option Restricted Stock Unit RSU Value Over Time Options have value if the stock price rises above the grant price, but could have no value if the stock price is at, or below, the grant price.

Then they are yours to hold or sell Taxation In most cases options are taxed as income at the time of exercise, regardless of whether shares are sold or held. Here are the questions I usually want to find out about the employee and the company before making a recommendation: How high of a risk tolerance do you have?

What tax bracket are you in? How stable has the stock performed over the last 3, 5, and 10 years? Compared to the stock market? How are the fundamentals of the stock right now? How does the sector that the stock is part of look for the future?

Recommended Articles, Handpicked for you Financial Planning. Recommended Articles, Handpicked For You 7 Keys to Unlocking Family Wealth.

Stock Options, Restricted Stock And Taxes

The Difference between Women and Men, Financially Speaking Part 1. Ten Steps to Securing Your Financial Future. Advice by Topic Business Financial Planning Comprehensive Financial Planning Cross Border Financial Planning 1.

Employee Stock Options ExplainedDivorce Financial Planning 8. Financial Planning for Widows 6. Special Needs Financial Planning 9. Expert Financial Advice Delivered to your inbox. Company Info About Us Newsroom Careers Contact Blog. Explore K Plan Ratings Advisor Pages Fund Pages Financial Insights FAQ. For Advisors Advisor Pages Spyglass. Social Facebook Twitter LinkedIn.

Legal Privacy Policy Terms of Use. No Reproduction without Prior Authorizations. RSUs become actual shares on vesting. Then they are yours to hold or sell.