Employee stock options cliff

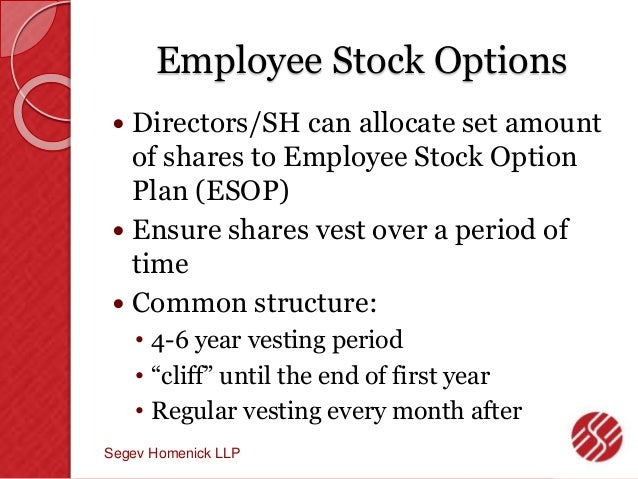

March 7, 6 min read. When you give options to your employees, keep in mind that many, if not most, of them have never seen anything like this before. Does this mean I own stock in the company? Options give employees the right to acquire stock in the company at a future time for today's price.

What You Need To Know About Vesting Stock - Wealthfront Knowledge

Until the employee exercises the options swaps the options for actual shares , the employee has none of the rights of a shareholder. If the company has a shareholders agreement in place, employees should be required to sign onto the agreement when they exercise their options and become shareholders.

Employee Equity: Restricted Stock and RSUs – AVC

Is that what I pay for the stock? Par value has nothing to do with what the employee will pay when exercising his options. Par value is an arbitrary amount used by accountants and lawyers to establish the stated capital of the company.

Because some states such as Delaware impose taxes on a company's stated capital, par values are set as low as possible. The exercise price, or strike price, is what employees pay for shares when they exercises options. How did you come up with the exercise price? By having an independent appraiser determine the market value of the company, and then dividing that value by the number of issued and outstanding shares of stock.

Why must I pay for my shares? Why aren't they just free?

Because of tax laws. If a company gives shares to employees for free, the employees are taxed on the full market value of the shares at ordinary income rates see below. The exercise price cannot be lower than the company's market value per share at the time of grant. Otherwise, the employee receives a taxable bargain. I've been working here for years. Why aren't some of my options vesting now to reflect my years of service? Because if they vested now, the employees would be socked with taxes on the full fair market value of the shares they received upon exercising the option.

Since options are considered compensation, that value would be taxed at very high ordinary income rates. What the heck is a cashless exercise? Does that mean I get stock for free?

Cashless exercise is actually a good thing for the employee. If an optionee needs to exercise options to avoid their expiration, for example but cannot afford to pay the strike price in cash, electing a cashless exercise enables the employee to receive some not all of their options without having to pay a penny for them.

Here's an example of how it works: By electing a cashless exercise for all 1, shares, here's what would happen: The employee would receive the balance of the shares 1, minus equals This, of course, results in the optionee having a significantly lower percentage ownership of the company than was initially promised to her but without having to pay anything for that lower percentage.

What happens if I leave the company? This depends on what the option agreement says. Generally, if an employee quits or is terminated "without good cause" for example, in a downsizing , the employee loses all options that have not yet vested and is required to exercise her vested options within a short period of time usually 90 days after termination or else lose them.

Some plans allow employees up to one year to exercise options if termination was due to their death or permanent disability.

Allowing an employee who has cheated the company to become a stockholder is one of the dumbest things a company can do. To find out more about Cliff Ennico and other Creators Syndicate writers and cartoonists, visit our webpage at www. Please enable Javascript for the best user experience.

All Columns Opinion Lifestyle Special Sections Books Books Get Published Audiobooks Sumner Books Cartoons Comics Editorial Puzzles Syndication Submissions Permissions Contact Content Downloads Settings Subscriptions Logout User Log in Register. When You Give Employees Stock Options, Expect These Questions By Cliff Ennico March 7, 6 min read Tweet.

Here are the most common questions they will ask, and my best answers.

How an Employee Stock Ownership Plan (ESOP) Works

About Cliff Ennico Read More RSS Subscribe Contact. YOU MAY ALSO LIKE Social Security and You Open House This Woman's Work Ask Carrie.

Bringing Your Nonprofit Organization Back to Life By Cliff Ennico "Some friends and I formed a nonprofit organization 10 years ago to help at-risk youth in our community. One of our bo Keep reading.

IBM Employee Highlights | Retirement Heist

Writer and mother Annie Lane writes in a voice that's sympathetic, funny and firm, offering common-sense solutions to life's dilemmas. Verify you are human. Syndication Comics Opinion Lifestyle Editorial Cartoons Special Sections Publishing All Titles Audiobooks Sumner Books Company About Press Contact Submissions Permissions.