Put options leveraged etfs

The information on this website solely reflects the analysis of or opinion about the performance of securities and financial markets by the writers whose articles appear on the site. The views expressed by the writers are not necessarily the views of Minyanville Media, Inc. Nothing contained on the website is intended to constitute a recommendation or advice addressed to an individual investor or category of investors to purchase, sell or hold any security, or to take any action with respect to the prospective movement of the securities markets or to solicit the purchase or sale of any security.

Any investment decisions must be made by the reader either individually or in consultation with his or her investment professional.

Minyanville writers and staff may trade or hold positions in securities that are discussed in articles appearing on the website. Writers of articles are required to disclose whether they have a position in any stock or fund discussed in an article, but are not permitted to disclose the size or direction of the position.

Leveraged ETF option strategies: Managerial Finance: Vol 42, No 5

Nothing on this website is intended to solicit business of any kind for a writer's business or fund. Minyanville management and staff as well as contributing writers will not respond to emails or other communications requesting investment advice. Copyright Minyanville Media, Inc. The article you are trying to read is not available now.

ETF Database: The Original & Comprehensive Guide to ETFs

Thank you very much; you're only a step away from downloading your reports. You will receive a download link right in your email inbox for each of the free reports that you choose.

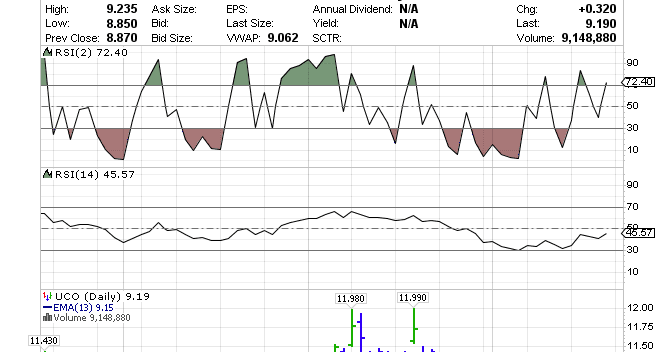

Options on Leveraged ETFs: By Bill Luby May 29, 8: Or a way to mellow volatile exchange-traded funds? Several readers noted that options on leveraged ETFs seemed like a recipe for disaster - as if no good could possibly come from piling leverage on top of leverage.

While I certainly understand the sentiment, this type of thinking is typical of investors who have little or no experience in options.

To the investor who isn't versed in options, the options world often seems to be limited to an occasional covered call or an out-of-the-money call that's barely distinguishable from a lottery ticket - and seems to pay out just about as often.

In fact, a large percentage of options traders are attracted to options because they're an excellent way to define, limit and manage risk.

Yes, one can buy a put to provide protection for a long stock protection, but in the absence of owning the underlying be it as stock, ETF, index or whatever , options traders are particularly fond of creating multi-leg options positions where the downside risk is known at the beginning of the trade and doesn't waver as long as the position is maintained.

Getting back to leveraged ETFs, I've reproduced a portion of the options chain for FAS --perhaps the most notorious of the Direxion triple ETFs -- in the table below. With a current mean implied volatility of , FAS is a highly volatile ETF. The June 11 calls, which are This is but one example of how options can limit the risk of trading triple ETFs. There are many other potential examples.

The bottom line is that options trades can be structured in such a manner that they're much less risky than stock trades, even if the options are on volatile securities such as triple ETFs.

As an aside, readers may have noticed that up to this point, I've somewhat standardized on the options tools and graphics available through optionsXpress.

Going forward, I'll make an effort do a better job of highlighting some of the tools and content available at various other options brokers in order to illustrate some of what's available to the reader, and at the very minimum, provide more visual variety.

SPXL: The Best Way To Short The Market - Direxion Daily S&P Bull 3x Shares ETF (NYSEARCA:SPXL) | Seeking Alpha

View As One Page. Follow Us On Twitter. Get The Minyanville Daily Recap Newsletter.

How Inverse And Leveraged ETFs Actually Work - Show #027Stay current on financial news, entertainment, education and smart market commentary. WHAT'S POPULAR IN THE VILLE. Tata Mutual Fund Announces Five New Fund Offerings and One Current Scheme Under Own a Piece of India. Your One-Stop Destination For All IT Related Requirements. Can Bonds Rally to New All-Time Highs? The Whimpering of 5 Critical Financial Market Details.

Did Retail Just Put In A Huge Bottom?

SEC Halts Quadruple-Leveraged ETF Approval Process | ETF Trends

Business News Trading and Investing Sectors Special Features MV PREMIUM MV Education Center Video. Sitemap Contributor Bios Directory of Terms Archive Email Alerts RSS Feeds T3 Live Subscriptions Minyanville Merchandise. MinyanLand Minyanville Media Buzz and Banter. Privacy Policy Terms and Conditions Disclaimers.