Inside bar trading stocks

Justin Bennett is a Forex trader, coach and founder of Daily Price Action. He began trading equities and ETFs in and later transitioned to Forex in His "aha" moment came in when he discovered the simple yet profitable technical patterns he teaches today.

Justin has now taught more than 1, students from 53 countries in the Daily Price Action course and community.

Follow JustinBennettFX Recent Lessons. Of the price action strategies we use here at Daily Price Action, the inside bar is the least common. Why is that, you ask? In other words, a trend that is strong but not exhausted. However, when you know what to look for, these setups can be quite profitable.

As the name implies, an inside bar forms inside of a large candle called a mother bar. This is why trading this pattern can be so profitable — you are essentially buying or selling a breakout, or continuation of the preceding trend. Notice how the second candle in the image above is completely engulfed, or contained, by the previous candle. In this case, the bearish candle mother bar represents a broader downtrend, while the bullish candle inside bar represents consolidation after the large decline.

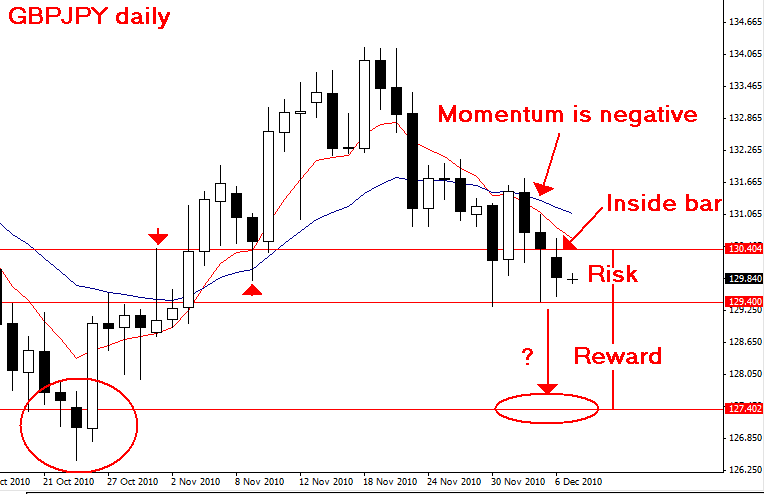

First and foremost, the time frame you use to trade inside bars is extremely important. This means more traders were actively involved in its formation, which as a result equals higher capital flows. Ah, the age-old saying — the trend is your friend. As common as this saying may be, it has never lost its significance in the financial markets, especially when it comes to trading inside bars. The first example is what you want to look for while the second is what you should avoid.

Inside bar setup with the trend what to look for. Note that this pair was in a strong uptrend leading up to both setups. This is the kind of momentum you want to look for when trading this strategy. The inside bars in the chart above formed on the GBPJPY daily chart in a choppy market. The best inside bar setups form just after a break of consolidation where the preceding trend is set to resume. The reason for this is quite simple….

In an uptrend, the consolidation is triggered when longs decide to begin taking profits selling. This causes the market to pullback, where new buyers step in and buy, which keeps prices elevated. This pattern continues for days, weeks or even months until new buyers are able to once again outweigh the sellers and drive the market higher.

Below is a great example of a bullish inside bar that formed on the USDCAD daily time frame. This is actually a trade setup that was called here at Daily Price Action and has worked out beautifully thus far. Notice how the bullish inside bar above formed after USDCAD broke out from multi-week consolidation.

Of course the opposite holds true for trading a bearish inside bar after a break of consolidation. Each and every strategy needs to be accompanied by a favorable risk to reward ratio.

Chuck Hughes OTME

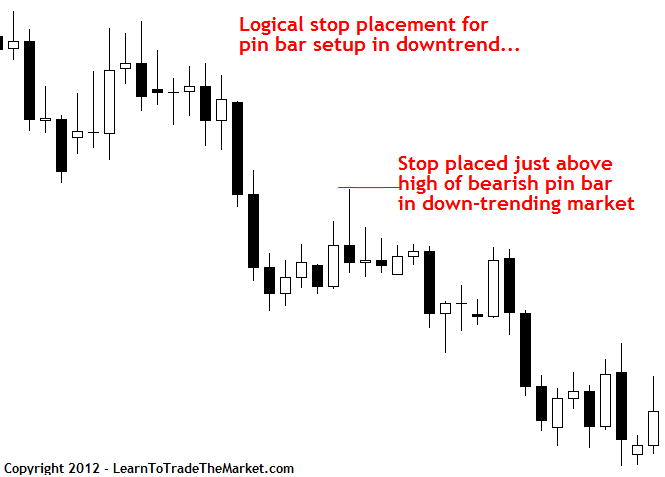

So if your take profit is pips, your stop loss can be no more than pips away from your entry price. If using the more aggressive stop loss strategy , this means selecting inside bars that form near the upper or lower range of the mother bar.

This allows you to achieve a much more favorable risk to reward ratio.

This is what you want to see in a favorable setup, especially if you are using the more aggressive stop loss placement, which means placing your stop loss below the inside bar rather than the mother bar. The same holds true for the bearish inside bar pictured above — the formation at the lower range of the mother bar is more favorable as it provides you with a better risk to reward ratio.

Again, this assumes that you are placing your stop loss above the high of the inside bar rather than the high of the mother bar. Last but not least, the size of the inside bar relative to the mother bar is extremely important.

Inside Day - 3 Trading Strategies - Tradingsim

This idea piggybacks off of number four above, where the inside bar forms in the upper or lower range of the mother bar. In my experience, the smaller the inside bar is relative to the mother bar, the greater your chances are of experiencing a profitable trade setup. Ideally, we want to see the inside bar form within the upper or lower half of the mother bar.

Remember that an inside bar represents consolidation after a large move. This is what makes these patterns so lucrative — the fact that we are trading a breakout after a period of consolidation.

The only thing that matters is whether the mother bar is bullish or bearish. By doing so, you limit your trade potential to the point that you are likely to begin taking subpar setups.

The inside bar setup is capable of producing consistent profits, but only to the traders who mind the five characteristics discussed above. Do you currently trade inside bars? Do you see yourself taking a different approach to trading them having read this lesson?

Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information. By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Daily Price Action, its employees, directors or fellow members.

Futures, options, and spot currency trading have large potential rewards, but also large potential risk.

You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website.

The past performance of any trading system or methodology is not necessarily indicative of future results. Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you.

Inside Bar Trading Strategy

You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets.

Forex trading involves substantial risk of loss and is not suitable for all investors.

Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. Private Trading Community Login Sign up for a lifetime membership. Why I Ditched Technical Indicators And Why You Should Too. How to Profit From the Head and Shoulders Pattern And Avoid Common Mistakes. Trading the Broadening Wedge: Your Start to Profit Guide. How to Use Fibonacci Retracement to Spot Market Tops and Bottoms.

The 3-Step Approach to Forex Money Management and Risk Control. A Simple Yet Powerful Approach. What is an Inside Bar?

Copyright by Daily Price Action, LLC.