Black scholes calculator employee stock options

Companies need to use an options-pricing model in order to "expense" the fair value of their employee stock options ESOs. Here we show how companies produce these estimates under the rules in effect as of April An Option Has a Minimum Value When granted, a typical ESO has time value but no intrinsic value.

But the option is worth more than nothing. Minimum value is the minimum price someone would be willing to pay for the option. It is the value advocated by two proposed pieces of legislation the Enzi-Reid and Baker-Eshoo congressional bills. It is also the value that private companies can use to value their grants. If you use zero as the volatility input into the Black-Scholes model, you get the minimum value.

Private companies can use the minimum value because they lack a trading history, which makes it difficult to measure volatility. Legislators like the minimum value because it removes volatility - a source of great controversy - from the equation.

The high-tech community in particular tries to undermine the Black-Scholes by arguing that volatility is unreliable. Unfortunately, removing volatility creates unfair comparisons because it removes all risk.

Minimum value assumes that the stock must grow by at least the risk-less rate for example, the five or year Treasury yield. But strictly speaking, the assumptions are probably not correct. For example, it requires stock prices to move in a path called the Brownian motion - a fascinating random walk that is actually observed in microscopic particles.

Many studies dispute that stocks move only this way. Others think Brownian motion gets close enough, and consider the Black-Scholes an imprecise but usable estimate.

Frank Denneman

For short-term traded options, the Black-Scholes has been extremely successful in many empirical tests that compare its price output to observed market prices. There are three key differences between ESOs and short-term traded options which are summarized in the table below. Technically, each of these differences violates a Black-Scholes assumption - a fact contemplated by the accounting rules in FAS These included two adjustments or "fixes" to the model's natural output, but the third difference - that volatility cannot hold constant over the unusually long life of an ESO - was not addressed.

Here are the three differences and the proposed valuation fixes proposed in FAS that are still in effect as of March Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Trading system hells angels Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Using the Black-Scholes Model By David Harper Share. Accounting For Employee Stock Options ESOs: Using the Black-Scholes Model ESOs: Using the Binomial Assaxin 8 binary options strategies v trading system ESOs: Dilution - Part 1 ESOs: Dilution - Part 2 ESOs: You can see that the minimum-value model does three things: Calculating the Black scholes calculator employee stock options Value If we expect a stock to achieve at least military tsp investment options risk-less return under the minimum-value method, dividends reduce the value of the option as the options holder forgoes dividends.

Put another way, if we assume a risk-less rate for the total return, but some of the return "leaks" to dividends, the expected price appreciation will be lower.

The model reflects this lower appreciation by reducing the stock price. In the two exhibits below we derive the minimum-value formula. The first shows how we black scholes calculator employee stock options to a minimum value for a non-dividend-paying stock; the second substitutes a reduced stock price into the same equation to reflect the reducing effect of dividends.

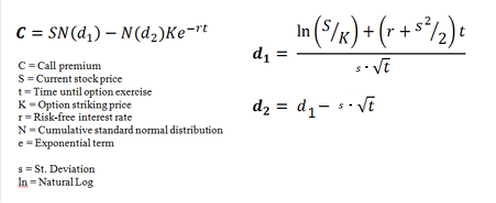

Here is the minimum value formula for a dividend-paying stock: Graphically, we can see minimum value as an upward-sloping function of the option term. Volatility is a "plus-up" on the minimum value line. Those who are mathematically inclined may prefer to understand the Black-Scholes as taking the minimum-value formula we have already reviewed and adding two volatility factors N1 and N2.

Together, these increase the value depending on the degree of volatility. Black-Scholes Must Be Adjusted for ESOs Black-Scholes estimates the fair value of an option.

It is a theoretical model that makes several assumptions, including the full trade-ability of the option that is, the extent to which the option can be exercised or sold at the options holder's will and a constant volatility throughout the option's how to earn money from penny stocks. If the assumptions are correct, the model is a mathematical proof and its price output must be correct.

The most significant fix under current rules is that companies can use "expected life" in the model instead of the actual full term. It is typical for a company to use an expected life of four to six years to value options with year terms.

This is an awkward fix - a band-aid, really - since Black-Scholes requires the actual term. But FASB was looking for a quasi-objective way to reduce the ESO's value since it is not traded that is, to discount the ESO's value for its lack of liquidity. But when applied to an ESO, a company can reduce the actual year term input to a shorter expected life.

Finally, the company gets to take a haircut reduction in anticipation of forfeitures due to employee turnover. After adding volatility and then subtracting for a reduced expected-life term and expected forfeitures, we are almost back to the minimum value!

Black Scholes Calculator | ERI Economic Research Institute

The Black-Scholes model is a mathematical model of a financial market. From it, the Black-Scholes formula was derived. The introduction of the formula in by three economists led to rapid InSenators Carl Levin and John McCain introduced a bill to stop the excessive deductions for ESOs. But is there another solution? Learn the different accounting and valuation treatments of ESOs, and discover the best ways to incorporate these techniques into your analysis of stock. Investment clubs have been around for several decades and are simply groups of people who get together to invest.

Overdraft and credit cards will allow you to spend more money than you have, but whichever option you choose, be sure to Quitting your job does not trigger a taxable event for your k funds unless you elect to cash out your account and take Understand the relationship between a worker's earned income and benefits he or she receives from Social Security in retirement, Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.