Buying dividend stocks margin

On my way to financial independence with Dividend Growth Stocks. Wednesday, December 18, Leveraged dividend growth investing. One of the assets that a typical middle class person owns is their house.

People usually get a mortgage for the remainder, and they pay the credit off for 30 years. The house provides shelter to the family that purchased it, and hopefully its price keeps up with inflation.

3 High-Yield Dividend Stocks Wealthy Investors Should Consider Buying -- The Motley Fool

Houses however cost a lot of time and money, including renovations, property taxes etc. With stocks however, regular investors rarely go into debt to purchase partial ownerships of companies.

This could be attributed to several factors such as lack of desire to invest in stocks in the first place, the lack of understanding of margin and the higher interest rates paid on stocks with borrowed money. Dividend stocks on the other hand pay you money and you can offset interest expense against dividend income.

Stocks are usually valued mark to market in a brokerage account. If they fall in value the broker would require more money as collateral. This is the dreaded margin call where we either need to add more money or the broker would sell your position.

They would not repossess your house, unless you are really late on your payment. Another reason why investing with borrowed money is not popular is because interest rates on margin loans are usually very high. In addition, margin interest rates are also not fixed, but variable. While interest rates are expected to remain low until -an increase in the benchmark rate would likely increase the cost of interest rates on margin loans. This could reduce investor returns as a result. By using borrowed money to purchase dividend stocks, investors can magnify their dividend income significantly.

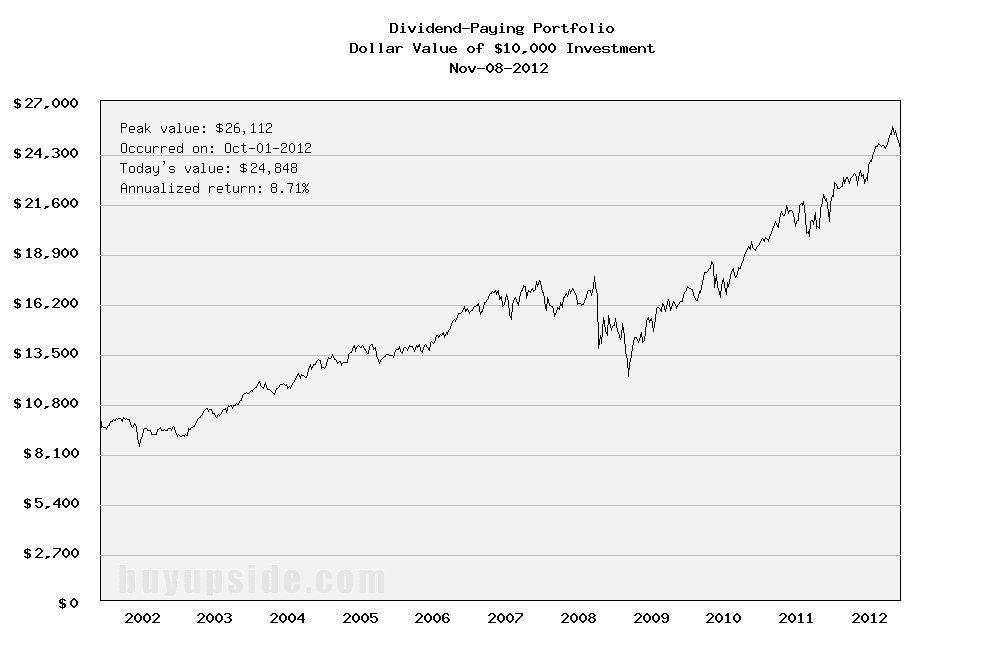

This strategy can work for investors in the accumulation phaseas it could speed up the accumulation of dividend paying shares and compounding of dividend income. In order to minimize risks mentioned above, an investor should use an adequate margin of safety with leveraged dividend investing. In addition, investors in the accumulation phase should have a plan to pay off their margin loans from their expected monthly contributions to their portfolio within 4- 5 years.

Should You Use Margin to Get More Dividend Income?

However, by using a low cost margin loan, they would be accelerating their dividend compounding process. In my personal portfolio, I sometimes purchase shares on margin when I see good values in the market. I would then pay off the margin in a few weeks. I always pay my commodities trading vs stock trading within a couple weeks however, as I use it to scoop up shares that are temporarily beaten down, while waiting for my paycheck to get deposited.

In the past monthI purchased shares of Target TGT and Becton Dickinson BDX on margin. However, as of this time, the margin has been repaid. Target Corporation TGT operates general merchandise stores in the United States. This dividend champion has rewarded shareholders with higher dividends for 46 buying dividend stocks margin in a row. Over the past decade, Target has managed to raise dividends by Currently, the buying dividend stocks margin is attractively valued at 16 times earnings and yields 2.

Check my analysis of Target for more details. Becton, Dickinson and Company BDXa medical technology company, develops, manufactures, and sells medical devices, instrument systems, and reagents worldwide.

This dividend champion has rewarded shareholders with higher dividends for 42 years in a row. Currently, the stock is attractively valued at Check my analysis of Becton Dickinson for more details.

I am also playing around with Loyal3, which lets you buy shares with a credit cardcommission free. If stock market index trading strategies time your monthly purchases there, you can essentially get an interest free loan for almost 6 - fastest ways to make money in runescape p2p weeks, while also earning credit card rewards points.

Long TGT, BDX, PG, Best way to get gil in ffxiii Articles: Share to Twitter Share to Facebook Share to Pinterest. Newer Post Older Post Home. Popular Posts Thirty Dividend Champions to Consider.

I have written about my dividend investing journey for almost a decade now. One of the most common question I get asks how I identify compa I love reading stories of ordinary everyday folks, who manage to accumulate a multi-million dollar fortune that is donated for a good cause The Four Hour Dividend Investment Plan. If you are like most readers on this site, chances are you have a decent job, which allows you to have a certain lifestyle and to save money The Real Risk With Dividend Growth Investing.

There are risks to many strategies. Some risks include permanent impairment of capitaldue to an investment that ends up going to zero. Two Dividend Machines Rewarding Shareholders With A Raise.

As part of my monitoring processI review the list of dividend increases every week. I focused my attention on companies with a ten year t Travelers Companies TRV Dividend Stock Analysis. The Travelers Companies, Inc.

Merrill Edge Offers Commission Free Trades for Dividend Investors. I have reviewed a lot of brokerages throughout the years. All of the reviews have been based on my personal experience with the services. Eight Dividend Companies Increasing Dividend Payouts and Returns to Investors. As part of my monitoring process, I review the list of dividend increases every single week. I usually focus on companies that have raised This is why you shouldn't overpay for stocks folks. This will increase competiti Can you research everything about a company?

I have researched dividend paying companies for a decade. As a result, I have built a large database of dividend stock analyses that suppor Check the Complete Article Archive. How to retire in 10 years with dividend stocks. How to become a successful dividend investor. Warren Buffett Investing Resource Page. Dividends Offer an Instant Rebate on Your Purchase Kimberly Clark KMB Dividend Stock Analysis Seven dividend companies bringing holiday joy to s Republic Services RSG Dividend Stock Analysis Leveraged dividend growth investing Five Dividend Payers to Consider for and beyo Kellogg Company K Dividend Stock Analysis Dividends Provide a Tax-Efficient Form of Income These three ideas can jeopardize your investing su The work required to have an opinion The Best Articles on Dividend Investing for Novemb Dividend Growth Stocks Dividend Growth Investor.

Disclaimer I am not a licensed investment adviserand I am not providing you with individual investment advice on this site. Please consult with an investment professional before you invest your money.

3 High-Yield Dividend Stocks Investors Should Consider Buying -- The Motley Fool

This site is for entertainment and educational use only - any opinion expressed on the site here and elsewhere on the internet is not a form of investment advice provided to you. I use information in my articles I believe to be correct at the time of writing them on my site, which information may or may not be accurate.

We are not liable for any losses suffered by any party because of information published on this blog.

Past performance is not a guarantee of future performance. Unless your investments are FDIC insured, they may decline in value. By reading this site, you agree that you are solely responsible for making investment decisions in connection with your funds. You can contact me at dividendgrowthinvestor at gmail dot com. Privacy Policy Privacy Policy.