Historical stock market dividend yield

Dividend yields from blue-chip U. However, the rate of dividend increases was the slowest since , when the country officially exited the Great Recession.

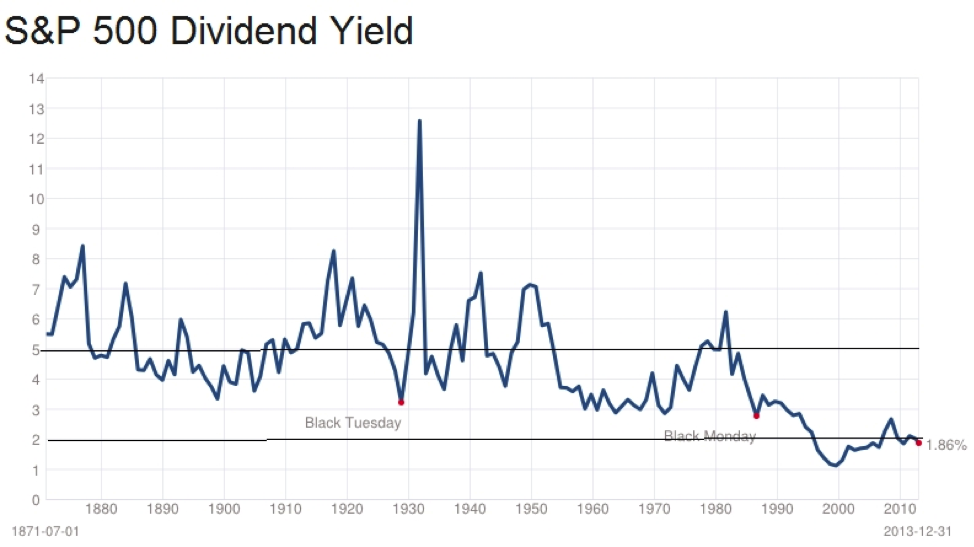

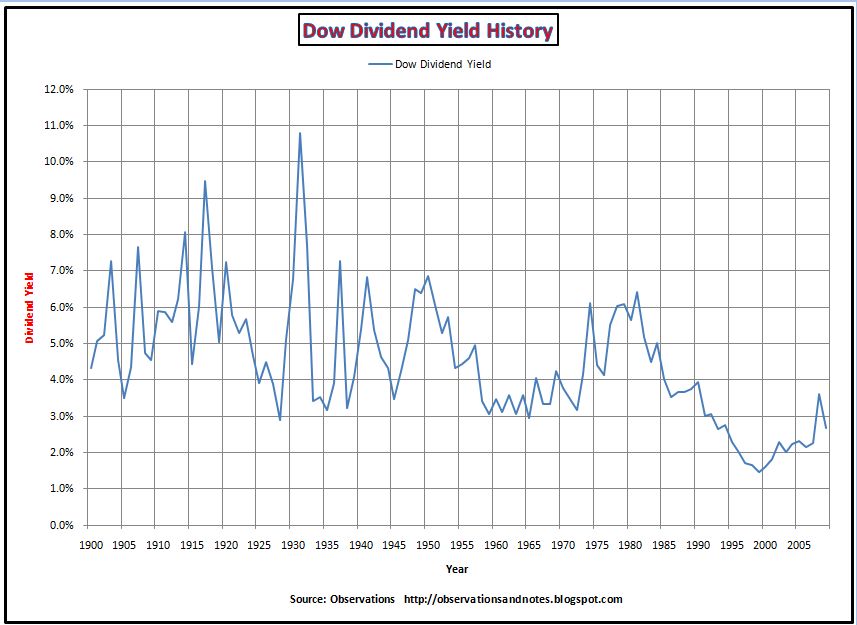

Slowed dividend growth is one more sign that small dividends remain the new normal. For example, the average dividend yield between and was 4. It declined to 1. After a brief climb to 3. Two major changes contributed to the collapse of dividend yields. The first was Alan Greenspan becoming chairman of the Federal Reserve in , a position he held until Greenspan responded to market downturns in , and with sharp drops in interest rates, which drove down the equity risk premium on stocks and flooded asset markets with cheap money.

Prices started climbing much faster than dividends. Technology stocks proved to be quintessential growth players and typically produced little or no dividends.

Access to this page has been denied.

Average dividends declined as the size of the tech sector grew. Some listed companies de-list and go private , while others merge or split into multiple companies. Listed companies might also undergo serious changes without new stock tickers emerging.

For example, Bank of America Corp.

Dividend Yield ExplainedIn , the bank experienced severe financial distress following a default on Russian bonds. It was subsequently acquired by NationsBank, which decided to keep the more recognizable name Bank of America Corp.

Such changes make equivalent comparisons difficult to make over time. All annual dividend yields are quoted in nominal terms and do not take into consideration the annual rates of inflation present over the same period. Inflation reduces the real impact of all returns, including dividends, and generally makes it more difficult to grow real wealth.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Other Disclaimers All annual dividend yields are quoted in nominal terms and do not take into consideration the annual rates of inflation present over the same period. High-dividend stocks make excellent bear market investments, but the payouts aren't a sure thing.

Discover the top five dividend-paying oil companies for and what factors contribute to their ability to continue dividend payments. Understanding dividends and how they work will help you become a more informed and successful investor. Investing in stocks that pay out dividends can be a smart way to establish a reliable income stream in retirement. Here are four low-fee dividend ETFs.

What Is The Average Dividend Yield of the Stock Market? | Finance - Zacks

Apple's dividend has had healthy growth ever since its reinstatement, thanks to Apple's continuously rising revenue, earnings and operating cash flow. Learn how to differentiate between dividend yield and dividend return, and see why dividend yield is the more popular rate Learn the importance of calculating the annual dividend yield and how income investors can use it to analyze companies in Learn about the average annual dividend yield for companies in the electronics sector and understand why the average is a Learn what the average annual dividend yield of insurance companies is and which factors should be considered when choosing Evaluate high-yield dividend stocks to determine if they are a good investment to produce steady income.

No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.