Algo trading system design

Previously on this blog I have written about the conceptual architecture of an intelligent algorithmic trading system as well as the functional and non-functional requirements of a production algorithmic trading system. According to this standard an architecture description must: In the context of this article, it is defined as the infrastructure within which application components which satisfy functional requirements can be specified, deployed, and executed.

Functional requirements are the expected functions of the system and its components. Non-functional requirements are measures through which the quality of the system can be measured.

A system which fully satisfies its functional requirements may still fail to meet expectations if nonfunctional requirements are left unsatisfied. To illustrate this concept consider the following scenario: Would this system meet your expectations? A conceptual view describes high level concepts and mechanisms that exist in the system at the highest level of granularity.

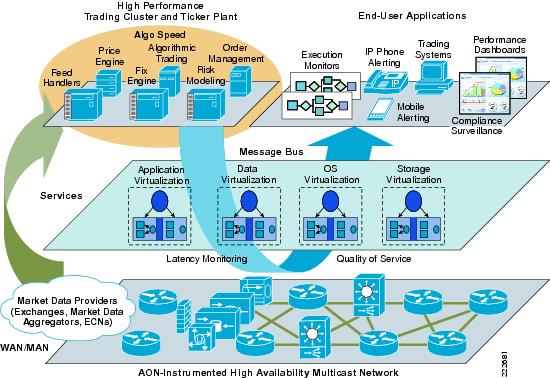

At this level, the algorithmic trading system follows an event driven architecture EDA broken up across four layers, and two architectural aspects. For each layer and aspect reference architectures and patterns are used. Architectural patterns are proven, generic structures for achieving specific requirements.

Architectural aspects are cross-cutting concerns which span multiple components. This diagram illustrates the conceptual architecture of the algorithmic trading system.

New Innovations in PCB Design Tools & Software | Altium Designer

To use an analogy, a reference architecture is similar to the blueprints for a load-bearing wall. This blue-print can be re-used for multiple building designs irrespective of what building is being built as it satisfies a set of commonly occurring requirements. Similarly, a reference architecture defines a template containing generic structures and mechanisms which can be used to construct a concrete software architecture that satisfies specific requirements.

The architecture for the algorithmic trading system uses a space based architecture SBA and a model view controller MVC as references. Good practices such as the operational data store ODS , the extract transform and load ETL pattern, and a data warehouse DW are also used.

The structural view of an architecture shows the components and sub-components of the algorithmic trading system. It also shows how these components are deployed onto physical infrastructure.

How to Build Your Own Working Algorithmic Trading Strategy

The UML diagrams used in this view include component diagrams and deployment diagrams. Below is gallery of the deployment diagrams of the overall algorithmic trading system and the processing units in the SBA reference architecture, as well as related component diagrams for each one the layers. According to the software engineering institute an architectural tactic is a means of satisfying a quality requirement by manipulating some aspect of a quality attribute model through architectural design decisions.

A simple example used in the algorithmic trading system architecture is 'manipulating' an operational data store ODS with a continuous querying component.

This component would continuously analyse the ODS to identify and extract complex events. The following tactics are used in the architecture: The above list are just a few design decisions I identified during the design of the architecture. It is not a complete list of tactics. As the system is being developed additional tactics should be employed across multiple levels of granularity to meet functional and non-functional requirements.

Below are three diagrams describing the disruptor design pattern, filter design pattern, and the continuous querying component. This view of an architecture shows how the components and layers should interact with one another. This is useful when creating scenarios for testing architecture designs and for understanding the system from end-to-end. This view consists of sequence diagrams and activity diagrams.

Algorithmic trading - Wikipedia

Activity diagrams showing the algorithmic trading system's internal process and how traders are supposed to interact with the algorithmic trading system are shown below.

The final step in designing a software architecture is to identify potential technologies and frameworks which could be used to realize the architecture. As a general principle it is better to leverage off of existing technologies, provided that they adequately satisfy both functional and nonfunctional requirements.

A framework is a realized reference architecture e. JBoss is a framework which realizes the JEE reference architecture. The following technologies and frameworks are interesting and should be considered when implementing an algorithmic trading system: Whilst not a technology or a framework, components should be built with an application programming interface API to improve interoperability of the system and its components.

The proposed architecture has been designed to satisfy very generic requirements identified for algorithmic trading systems.

Generally speaking algorithmic trading systems are complicated by three factors which vary with each implementation: The proposed software architecture would therefore need to be adapted on a case-by-case basis in order to satisfy specific organizational and regulatory requirements, as well as to overcome regional constraints.

The algorithmic trading system architecture should be seen as just a point of reference for individuals and organizations wanting to design their own algorithmic trading systems. For a full copy and sources used please download a copy of my report. Great overview, and a good start on the architecture.

Your conclusion was apt, and pointed out why algorithmic trading software systems require constant back-testing and tweaking to keep them relevant. When the data from commodities or fixed income is inaccurate or slow in being received the models could have a hard time calculating especially in the space of a Black Swann event. Thank you very much for this article. I've been thinking about AI in finance since the late 90s, and finally the technologies and APIs are commonly available.

Your article and blog is a great help to make those first steps to making the dreams of earlier years come true. Thanks a lot and good luck in your further ventures!

Sign me up for updates from this blog! Quantocracy is the best quantitative finance blog aggregator with links to new analysis posted every day. NMRQL is the quantitative hedge fund I'm a part of. We use machine learning to try and beat the market.

Turing Finance June 21, Hide Navigation Code Experiments Stochastic Models R4nd0m GitHub About This Site Turing Finance Stuart Reid Contact Suggestion Box. Algorithmic Trading Computational Finance.

Space-based architectural conceptual view Model View Controller original image: Continuous Querying Component diagram Disruptor design pattern class diagram source: Algorithmic trader interaction End-to-end algorithmic trading process.

Tags Algorithmic Trading Algorithmic Trading Systems. Share on Facebook Tweet This Share on Google Plus Pin This Email This. Previous Story Algorithmic Trading System Requirements Next Story Portfolio Optimization Using Particle Swarm Optimization. May 17, Reply. February 1, Reply.

June 3, Reply. July 16, Reply. Please keep me updated in your progress. I am very interested. Turing Finance Mailing List For email updates when I post a new article. It's free and I won't send you any spam. Friends of Turing Finance Quantocracy is the best quantitative finance blog aggregator with links to new analysis posted every day.

Turing Finance on Twitter My Tweets. Turing Finance on Facebook. Most Popular Posts 10 misconceptions about Neural Networks Regression analysis using Python Hacking the Random Walk Hypothesis Random walks down Wall Street, Stochastic Processes in Python Stock Market Prices Do Not Follow Random Walks Algorithmic Trading System Architecture How to be a Quant. Most Recent Posts Testing the Random Walk Hypothesis with R, Part One The Promise of Computing Lossless Compression Algorithms and Market Efficiency?

Stock Market Prices Do Not Follow Random Walks How to be a Quant Hacking the Random Walk Hypothesis A Quant's view of CFA Level I. Blogroll Alex Chinco's Blog Colah's Blog Compounding My Interests Ernie Chan Explained Visually Flirting with Models Gekko Quant Gestaltu Off The Convex Path Philosophical Economics Quandl Quant at Risk Quant Dare QuantInsti Quantocracy Quantopian Quantpedia Quants Portal QuantStart QuantStrat TradeR Robot Wealth Sebastian Rashka The Alpha Architect The Financial Hacker.

Popular Tags Agent-based Computational Economics Agent Based Model Algorithmic Trading Algorithmic Trading Systems Ant Colony Optimization Artificial Intelligence Computational Economics Computational Finance Computational Investing Correlation Analysis Economic Forecasting Neural Network Efficient Market Hypothesis Genetic Programming Machine Learning Neural network particle swarm optimization Portfolio optimization Quantitative Methods Randomness Tests Random Walk Hypothesis Regression Analysis RStats Self Organizing Map Stochastic Process Swarm Intelligence.

Disclaimer This is a personal blog. As such the opinions expressed here are my own and do not necessarily represent those of my employer. Furthermore, all information on this blog is for educational purposes and is not intended to provide financial advice.