Asian call option calculator

Asian option also known as average price option is an option whose payoff is determined with respect to the arithmetic or geometric average price of the underlying asset over the term of the option.

While the payoff of a standard American and European option depends on the price of the underlying asset at a specific point of time i.

Stock Options Analysis and Trading Tools on I fadukuvo.web.fc2.com

There are two types of Asian options with respect to the method of averaging: Asian options have relatively low volatility due to the averaging mechanism. They are used by traders who are exposed to the underlying asset over a period of time such as consumers and suppliers of commodities, etc. On 1 January 20Y3, a trader purchased a 90 day arithmetic call option on AOL, Inc.

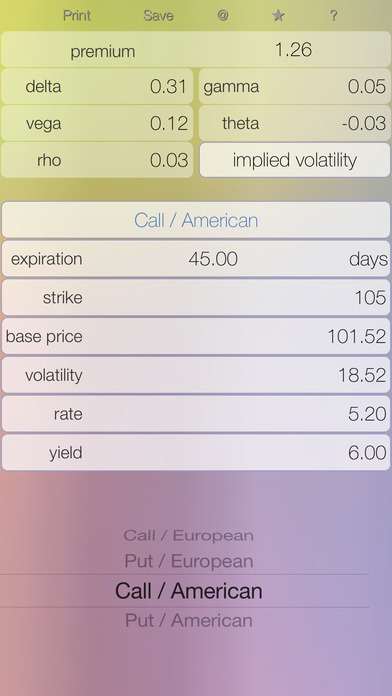

Option Price Calculator

Payoff of geometric Asian call option can be calculated by substituting the arithmetic average price of the underlying asset with its geometric equivalent. Refer to data in Example 1 above, but assume that another trader bought a geometric put option with the same exercise price i.

The put option is out of the money because the geometric average of the underlying price is higher than the exercise price. Written by Obaidullah Jan.

Subjects Accounting Economics Finance Management Related Terms American Option European Option Put Option Call Option.