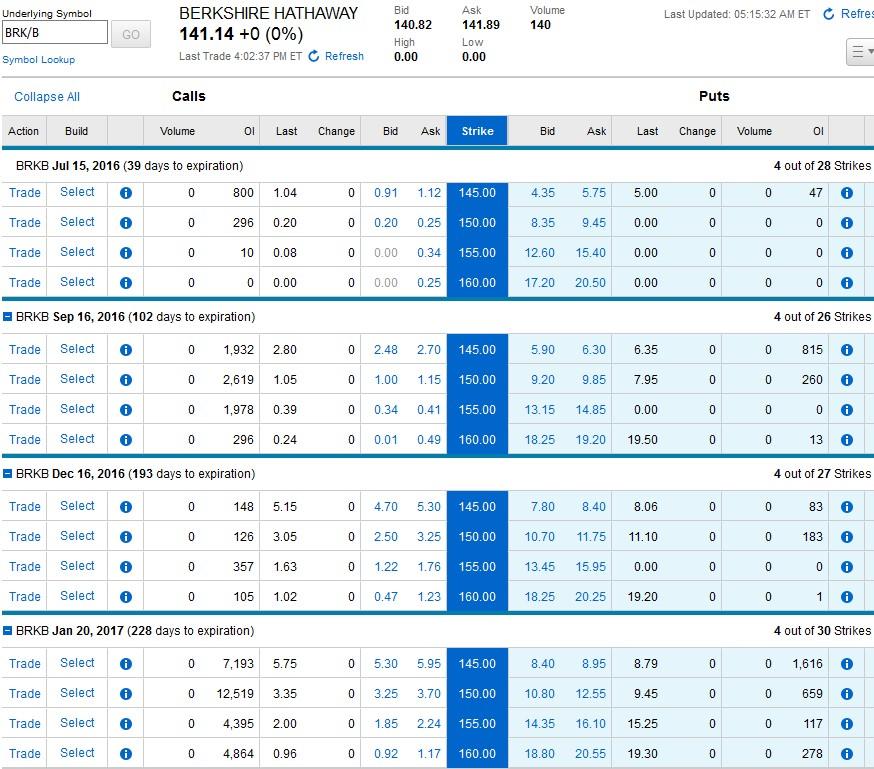

Brk.b call options

Berkshire Hathaway is an American multinational conglomerate holding company that oversees a number of subsidiaries that are involved and engaged in insurance, food service operations, energy distribution, manufacturing, and finance. With a beta of 1. Our first Covered Call on Berkshire was way back in November of , were we recommended a long-term out-of-the-money Call on Berkshire to generate income on a stock that represents some of the best management of any holding company on the planet.

TwinsTalkStocks think See's Candies and BRK.B is sweetThat strategy got called away in January netting us a 6. If you were crunching the numbers, you will see that if we had just bought BRKB without selling the Call, we would have made more money than we would have than using our Covered Call Strategy.

But let's be clear here, the purpose of that strategy was to create income in a relatively low-risk equity position for people that require it.

While Berkshire can be argued to be one of the best holdings one can have on the planet, and is headed by one of the most - if not the most - prolific investor the markets have seen, you do not buy Berkshire for explosive growth. Buffett is obviously concerned about the growth of his company, his investment mindset is not a short-term one, but rather is quite far-seeing.

The run the markets had in was spectacular, but is not "normal" for bull markets when related to the economic data we are seeing. Now that is all fine, as we are not concerned about the sky falling around us, but even so far this year we can see the increased volatility in the markets.

Investors' Business Daily classifies the current market as entering a correction phase due to the number of distribution days the market has seen.

While we can't quantify how serious a correction this though we expect at least one more serious correction by the end of the year we are going to look for a slightly out-of-the-money Call. While on some stocks we would normally sell an in-the-money Call if we thought a correction was imminent, it is really hard to do that with a company like BRKB which is managed so well, has such a great, long-standing track record against the market, and has the near-term technicals to support a bullish move in the stock.

Access to this page has been denied.

Like we said though, it pays to be cautious and take some money off the table by getting a larger premium with a closer strike price for a conservative equity position in a stock that has a stellar track record in tough market conditions. As active managers OakTree Investmetent Advisors may increase or decrease our position in BRKB as markets dictate.

REHeakins' Blog long only, Growth, momentum, investment advisor. Blog posts are not selected, edited or screened by Seeking Alpha editors.

Buying Berkshire Hathaway Inc. And Selling A Covered Call Mar.

Berkshire Hathaway Inc. options by expiration - Google Finance

BRKB Berkshire Hathaway is an American multinational conglomerate holding company that oversees a number of subsidiaries that are involved and engaged in insurance, food service operations, energy distribution, manufacturing, and finance. BRKB currently pays no dividend.

Prices may vary from the time of post. Actual commissions paid will vary returns.

BRK.B: Berkshire Hathaway Inc. - Options Chain - fadukuvo.web.fc2.com

Static Return Not Called: The above numbers are analytic estimations based on information known at the time of this post. OakTree Investment Advisors does not guarantee the above, or any, result. All investment decisions should be made based upon individual's personal investment goals and risk tolerance. Weekly Picks Previous Post Disclosure: I am long BRK.