Options strangle strategy short

A strangle is an options strategy where the investor holds a position in both a call and put with different strike prices but with the same maturity and underlying asset.

This option strategy is profitable only if there are large movements in the price of the underlying asset. This is a good strategy if you think there will be a large price movement in the near future but are unsure of which way that price movement will be.

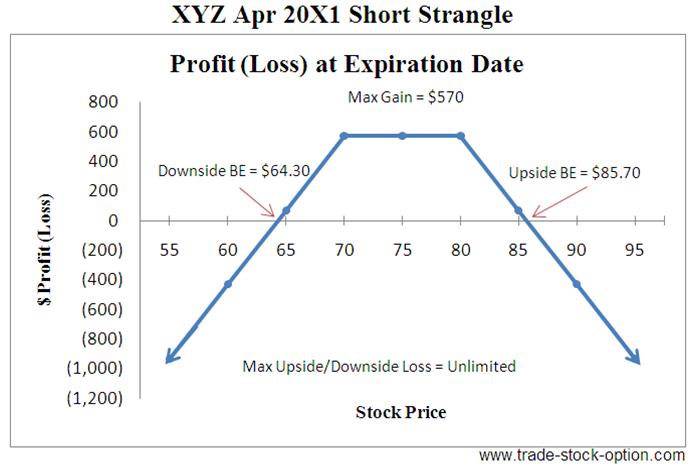

A long strangle theoretically has an unlimited profit potential because it involves purchasing a call option. Conversely, a short strangle is a neutral strategy and has limited profit potential.

The maximum profit that could be achieved by a short strangle is equivalent to the net premium received less any trading costs. The short strangle involves selling an out-of-the-money call and an out-of-the-money put option. Long strangles and long straddles are similar options strategies that allow investors to gain from large potential moves to the upside or downside.

Options Strategy Library by fadukuvo.web.fc2.com

However, a long straddle involves simultaneously purchasing an at-the-money call and an in-the-money put option. A short straddle is similar to a short strangle and has a limited maximum profit potential that is equivalent to the premium collected from writing the at-the-money call and put options.

Therefore, a strangle is generally less expensive than a straddle as the contracts are purchased out of the money. To employ the strangle option strategy, a trader enters into two option positions, one call and one put.

Options strategies - Wikipedia

The trader will make money if the price of the stock starts to move outside the range. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

Long Straddle Option Strategy - The Options Playbook

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Short Strangle (Sell Strangle) Explained | Online Option Trading Guide

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.