Stock market timing strategies

Market timing is the strategy of making buy or sell decisions of financial assets often stocks by attempting to predict future market price movements. The prediction may be based on an outlook of market or economic conditions resulting from technical or fundamental analysis.

This is an investment strategy based on the outlook for an aggregate market, rather than for a particular financial asset. Whether market timing is ever a viable investment strategy is controversial. Some may consider market timing to be a form of gambling based on pure chance , because they do not believe in undervalued or overvalued markets. The efficient-market hypothesis claims that financial prices always exhibit random walk behavior and thus cannot be predicted with consistency.

Some consider market timing to be sensible in certain situations, such as an apparent bubble. However, because the economy is a complex system that contains many factors, even at times of significant market optimism or pessimism, it remains difficult, if not impossible, to predetermine the local maximum or minimum of future prices with any precision; a so-called bubble can last for many years before prices collapse.

Likewise, a crash can persist for extended periods; stocks that appear to be "cheap" at a glance, can often become much cheaper afterwards, before then either rebounding at some time in the future or heading toward bankruptcy.

Proponents of market timing counter that market timing is just another name for trading. They argue that "attempting to predict future market price movements" is what all traders do, regardless of whether they trade individual stocks or collections of stocks, aka, mutual funds. Thus if market timing is not a viable investment strategy, the proponents say, then neither is any of the trading on the various stock exchanges.

Those who disagree with this view usually advocate a buy-and-hold strategy with periodic "re-balancing". Others contend that predicting the next event that will affect the economy and stock prices is notoriously difficult. For examples, consider the many unforeseeable, unpredictable, uncertain events between and that are shown in Figures 1 to 6 [pages 37 to 42] of Measuring Economic Policy Uncertainty.

The Federal Reserve Bank of Kansas City has published a review of several relatively simple and statistically successful market-timing strategies.

Institutional investors often use proprietary market-timing software developed internally that can be a trade secret. Some algorithms , like the one developed by Nobel Prize—winning economist Robert C. Merton , attempts to predict the future superiority of stocks versus bonds or vice versa , [3] [4] have been published in peer-reviewed journals and are publicly accessible.

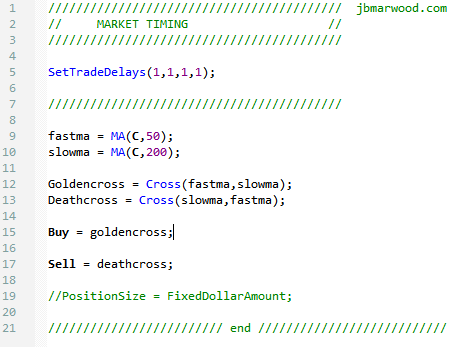

Market timing often looks at moving averages such as and day moving averages which are particularly popular. The market timers then predict that the trend will, more likely than not, continue in the future. Others say, "nobody knows" and that world economies and stock markets are of such complexity that market-timing strategies are unlikely to be more profitable than buy-and-hold strategies.

Moving average strategies are simple to understand, and often claim to give good returns, but the results may be confused by hindsight and data mining. Perhaps consistent with these two opposing views is that, as with any type of trading, market timing is difficult to carry out on a consistent basis, particularly for the individual investor unschooled in technical analysis.

Retail brokers are also generally unschooled in both the mindset and the tools needed to successfully time the market, and indeed most are actively discouraged by the brokerages themselves from moving their clients in and out of the market.

However, as market makers , many of these same brokerages take the opposite approach with their large institutional clients, trading various financial instruments for these clients in an attempt to "predict future market price movements" and thereby make a profit for the institutions. This dichotomy in the treatment of institutional versus retail clients can potentially be controversial for the brokerages. It may suggest for example that retail brokers and their clients are discouraged from market timing, not because it does not work, but because it would interfere with the brokerages' market maker trading for their institutional clients.

In other words, retail clients are encouraged to buy and hold so as to maintain market liquidity for the institutional trading. If true, this would suggest a conflict of interest, in which the brokerages are willing to sacrifice potential returns for the smaller retail clients in order to benefit larger institutional clients.

The decline in the markets was instructive.

While many retail brokers were instructed by their brokerages to tell their clients not to sell, but instead "look to the long term", the market makers at those same brokerages were busy selling to cash to avoid losses for the brokerages' large institutional clients.

The result was that the retail clients were left with huge losses while the institutions fled to the safety of short-term bonds and money market funds, thereby avoiding similar losses. Regarding University of Michigan Consumer Sentiment Index , Thomson Reuters announced on 8 July that it was suspending its early release practice as part of an agreement with the New York Attorney General's office. A major stumbling block for many market timers is a phenomenon called " curve fitting ", which states that given set of trading rules has been over-optimized to fit the particular dataset for which it has been back-tested.

Maybe the best market-timing system ever - MarketWatch

Unfortunately, if the trading rules are over-optimized they often fail to work on future data. Market timers attempt to avoid these problems by looking for clusters of parameter values that work well [9] or by using out-of-sample data, which ostensibly allows the market timer to see how the system works on unforeseen data. Critics, however, argue that once the strategy has been revised to reflect such data it is no longer "out-of-sample".

Several independent organizations e.

Market Timing Tips & Rules Every Investor Should Know | Investopedia

These organizations have found that purported market timers in many cases do no better than chance, or even worse. However, there were exceptions, with some market timers over the thirty-year period having performances that substantially and reliably outperformed the general stock market, such as Jim Simons ' Renaissance Technologies , which allegedly uses mathematical models developed by Elwyn Berlekamp.

A recent study suggested that the best predictor of a fund's consistent outperformance of the market was low expenses and low turnover, not pursuit of a value or contrarian strategy. Mutual fund flows are published by organizations like Investment Company Institute and TrimTabs. For example, in the beginning of the s, the largest in flows to stock mutual funds were in early while the largest outflows were in mid It is good to note that these mutual fund flows were near the start of a significant bear downtrending market and bull uptrending market respectively.

A similar pattern is repeated near the end of the decade. Louis confirms the correlation showing return-chasing behavior. This mutual fund flow data seems to indicate that most investors despite what they may say actually follow a buy-high, sell-low strategy. However, eventually, the supply of buyers becomes exhausted, and the demand for the stock declines and the stock or fund price also declines.

After inflows, there may be a short-term boost in return, but the significant result is that the return over a longer time is disappointing. Researchers suggest that, after periods of higher returns, individual investors will sell their value stocks and buy growth stocks. Frazzini and Lamont find that, in general, growth stocks have a lower return, but growth stocks with high inflows have a much worse return.

For the year period to the end of , the inflation-adjusted market return was about 5. Dalbar's studies say that the retention rate for bond and stock funds is three years.

This means that in a year period the investor changed funds seven times. Balanced funds are a bit better at four years, or five times. Some trading is necessary since not only is the investor return less than the best asset class, it is typically worse than the worst asset class, which would be better.

While market-timing strategies are legal, the Financial Industry Regulatory Authority FINRA has long frowned on the practice because it passes trading costs to long-term investors. Consequently, many brokerages will not fill market-timing orders. Financial advisors often agree that investors have poor timing, becoming less risk averse when markets are high and more risk averse when markets are low , a strategy that will actually result in less wealth in the long-term compared to someone who consistently invests over a long period regardless of market trends.

Similarly, Peter Lynch has stated that "Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves. Spock of Star Trek , capable in most circumstances of logical, emotionally-detached analysis. Proponents of the efficient-market hypothesis EMH claim that prices reflect all available information.

EMH assumes that investors are highly intelligent and perfectly rational. However, others dispute this assumption.

William Schwert, and Robert F. Stambaugh wrote that an unexpected increase in volatility lowers current stock prices. Total Factor Productivity TFP Growth Volatility is negatively associated with the value of U. From Wikipedia, the free encyclopedia. Building Winning Trading Systems with TradeStation TM , Hoboken, N.

ISBN , p. Journal of Portfolio Management , 31 Special Issue , p. Journal of Portfolio Management , 29 , p.

Louis Fed On the Economy". Chart of the Week: Mutual fund flows and the cross-section of stock returns. Journal of Financial Economics 88 — Proof That You Stink At Investing".

William Schwert and Robert F. Primary market Secondary market Third market Fourth market. Common stock Golden share Preferred stock Restricted stock Tracking stock. Authorised capital Issued shares Shares outstanding Treasury stock. Broker-dealer Day trader Floor broker Floor trader Investor Market maker Proprietary trader Quantitative analyst Regulator Stock trader.

Stock Market Timing, ETF Signals, ETF Timing, ETF Newsletter

Electronic communication network List of stock exchanges Opening times Multilateral trading facility Over-the-counter.

Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Algorithmic trading Buy and hold Concentrated stock Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value investing.

Block trade Cross listing Dark liquidity Dividend Dual-listed company DuPont analysis Efficient frontier Flight-to-quality Haircut Initial public offering Margin Market anomaly Market capitalization Market depth Market manipulation Market trend Mean reversion Momentum Open outcry Public float Public offering Rally Returns-based style analysis Reverse stock split Share repurchase Short selling Slippage Speculation Stock dilution Stock market index Stock split Trade Uptick rule Volatility Voting interest Yield.

Retrieved from " https: All articles with dead external links Articles with dead external links from June Articles with permanently dead external links Pages using ISBN magic links Articles needing cleanup from March All pages needing cleanup Cleanup tagged articles without a reason field from March Wikipedia pages needing cleanup from March Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. Languages Deutsch Edit links. This page was last edited on 3 June , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy.

Stock Market Cycles - How to Time Your Entries with PrecisionPrivacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view. This article may require cleanup to meet Wikipedia's quality standards. No cleanup reason has been specified. Please help improve this article if you can.

March Learn how and when to remove this template message.